We understand that everyone’s story is unique. That’s why we take time to get to know you, not just your financial details.

Key Features

-

![]() Market-Leading Rates

Market-Leading Rates

-

![]() People You Know and Trust

People You Know and Trust

-

![]() Local Decision-Making

Local Decision-Making

Here's What You Can Expect:

1

Get your documents together (2 years of W-2s, tax returns, pay stubs from the last 30 days, and 2 months of bank statements).

2

Apply online. It takes about 20 minutes!

3

We'll review your application. Hang tight for a call from our mortgage team!

Meet your Home Loan Experts

Home — it's where your story happens.

We do mortgage lending all the time, and it's still a big deal. There's nothing we enjoy more than helping people with the purchase of their own home. Envista strives to keep our rates low while pushing our customer service off the charts. That's pretty much the perfect combination of what you'd want in a mortgage lender.

- Competitive rates

- Wide range of terms

- Free pre-approval

- Local decision-making, in-house processing and servicing

- Detailed, friendly service from experienced lenders

The first step in buying a home is getting prequalified — this tells you how much you can borrow for a home. Connect with our team and let's get you on the path to homeownership.

We're proud to offer:

- Conventional Loans

- Conventional Loans

- Home Possible Loans

- Home One Loans

- FHA Loans

- VA Loans

- USDA Loans

- Land & Construction Loans

- Refinance Accelerator Loans

- First-Time Home Buyer Grant Program

- Home Equity Loans

Our team can help you determine which home loan is the best fit for your individual situation.

Buying your first home can be exciting, but anxiety-inducing at the same time. Our home loan experts are there for you in the moments that matter, and navigating the home buying process is definitely one of those. We take great pride in listening to what's important to you, helping you choose the best loan for your needs and providing education and peace of mind through the process.

First-Time Home Buyer Program

Envista participates in the Homeownership Set-Aside Program (HSP) that offers up to $7,500 in down payment and closing cost assistance to first-time home buyers. Our team is trained to assist first time home buyers in understanding and completing the grant requirements. Email or call us to get the conversation started.

More About First-Time Home Buyer Grants

The HSP grant program is a first-come first served basis and is available until the funds in the program have been exhausted.

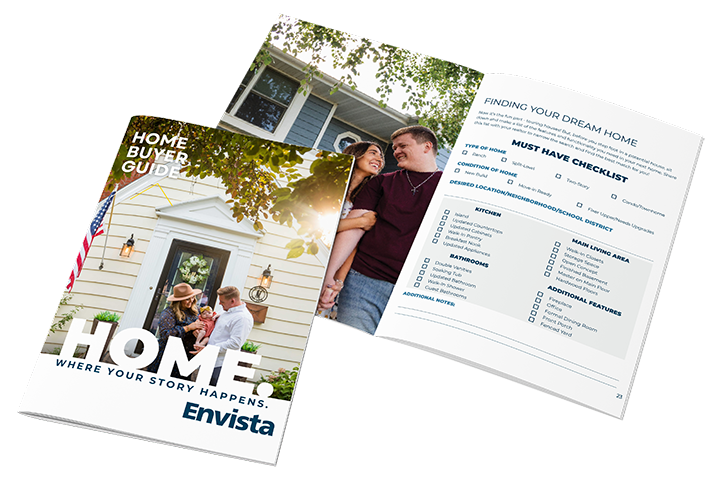

Free Home Buyer's Guide

We know the thought of buying a home can be overwhelming and confusing. It's our goal to make the process as easy, efficient, and joyful as possible. Having the right information is essential to achieving a great home buying experience. We've created a Buyer's Guide full of home buying checklists, tips and tricks, just for you. Download your free copy!

Download a FREE Home Buyer Guide

Blog

Follow our blog for everything from the best-kept secrets of homebuying to tips for sellers.

“The mortgage team at Envista was by our side keeping us informed, respecting our questions and making sure our mortgage financing was the easiest part of our home buying experience.” - Ashley S

“There are enough worries and decisions when building a home. Envista made it easy and handled all of our contractor invoices and questions quickly and without error. With Envista I felt confident knowing the check would be in the mail the next day, keeping my contractors paid and on task.” - Katie H

“Our realtor introduced us to Envista’s mortgage team. They were very informative of mortgage financing process for our first home. They were knowledgeable, respectful, patient and most of all they had our back. Envista was able to help make our dream of homeownership, our reality.” - Gloria M

“We were pleased at the ease of accomplishing our long term goal of paying off our home. We locked into a great rate and closed on a 15 year mortgage. Upon retirement, we will own our home free and clear. Thank you, Envista!” - Craig M